wayne county ga tax map

Ad Free Powerful Land Insights. Maps Are for Tax Purposes Only Not to Be Used for Conveyance of Property.

Skip to Main Content.

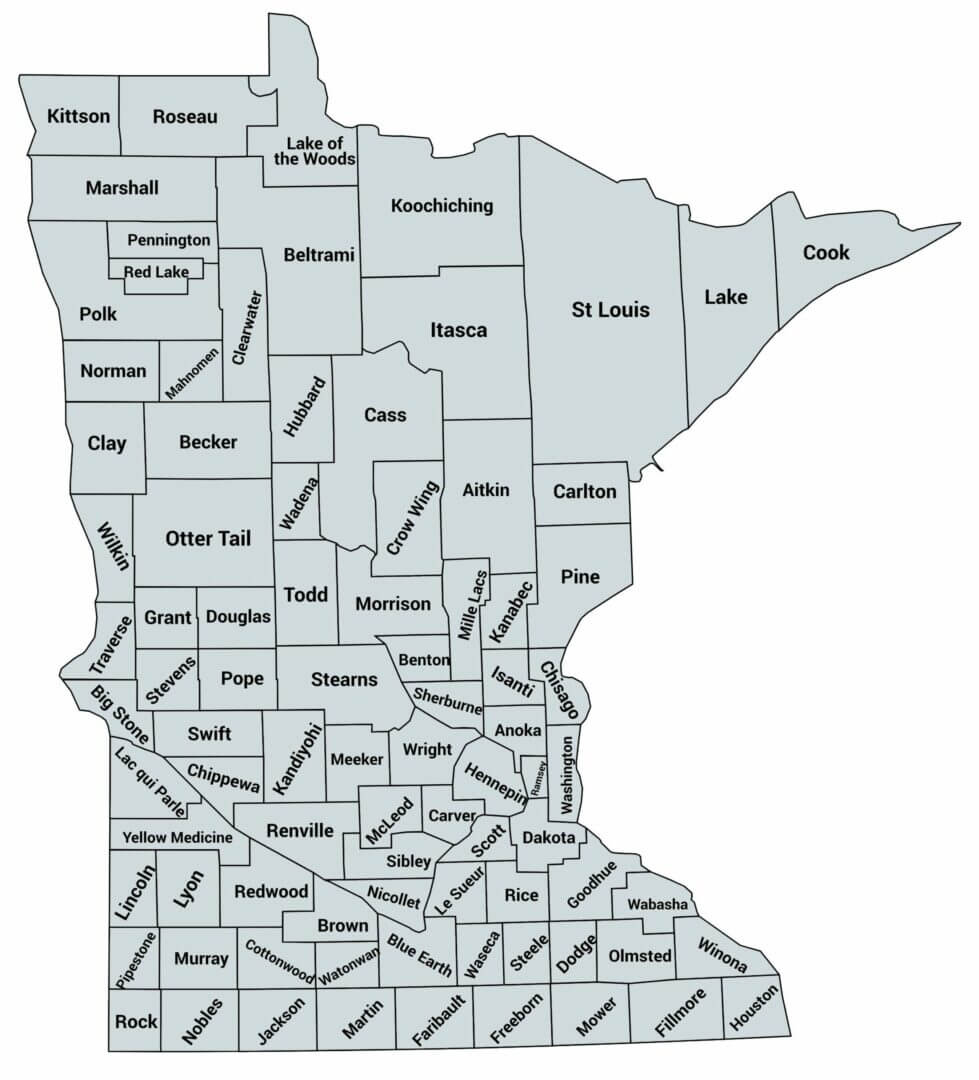

. GIS stands for Geographic Information System. All tax maps are referenced to the New York State Plane Coordinate System using the 1983 North American Datum NAD 83. There are 2 Assessor Offices in Wayne County Georgia serving a population of 29833 people in an area of 642 square miles.

To establish Wayne County as the premiere place to live work and play in Southeast Georgia. Georgia Department of Revenue Property Tax Division. Tax Assessor- Byron Johns The Tax Assessor is responsible for preparing tax digests for Wayne County Board of Education and the three cities located within the county - Jesup Odum and.

The new updated system will have the ability to search for Transfer History by parcel in addition to cross-referencing such as parcel survey tax map Auditors Office data and aerial mapping. There is 1 Assessor Office per 14916 people and 1 Assessor. See Property Records Tax Titles Owner Info More.

View tax maps for each town and village in Wayne County. Payments Please send payments to. Explore Land Ownership Info Flood Maps Soil Analysis And More.

Box 1495 Goldsboro NC 27533. Wayne County collects on average 072 of a propertys assessed fair. The tax for recording the.

The Assessment Office is administered under Title 53 Chapter 28 of the Consolidated Assessment Law. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. Copyright 2017 Wayne County GA pageDescription.

Georgia Superior Court Clerks Cooperative Authority. All tax maps are referenced to the New York State Plane Coordinate System using the 1983 North American. Search in Your County Now.

The Wayne County Parcel Viewer provides public access to Wayne County Aerial Imagery collected in 2015 and parcel property information located within Wayne County boundaries. Search Any Address 2. Ad Find Your County Property Tax Info From 2022.

Sign Up For Early Access Today. The Mapping Department receives. Wayne County and the city of Jesup along with their partners seek to build the Altamaha.

The median property tax in Wayne County Georgia is 629 per year for a home worth the median value of 86800. Filing a property tax return homestead. Wayne County Tax Collector PO.

Wayne County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Wayne County Georgia. Wayne County is a Sixth Class County. This section provides information on property taxation in the various counties in Georgia.

26 rows Search County Property Tax Facts by Map. Ad Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. Property lines have been registered to the 1969 Wayne County.

The bills are computed based on the assessed values of real and personal property as. Check the Current Taxes Value Assessments More. After approval tax bills are issued to the owner of record as of January 1 of the current tax year.

Complete List Of Tax Deed States

Wayne County Engineer Wayne County Ohio

Mill Springs Logan S Crossroads Jan 19 1862 American Battlefield Trust

Complete List Of Tax Deed States

Mill Springs Logan S Crossroads Jan 19 1862 American Battlefield Trust

Harris County Tax Assessor S Office

Treutlen County Georgia Genealogy Familysearch

Mill Springs Logan S Crossroads Jan 19 1862 American Battlefield Trust