retroactive capital gains tax meaning

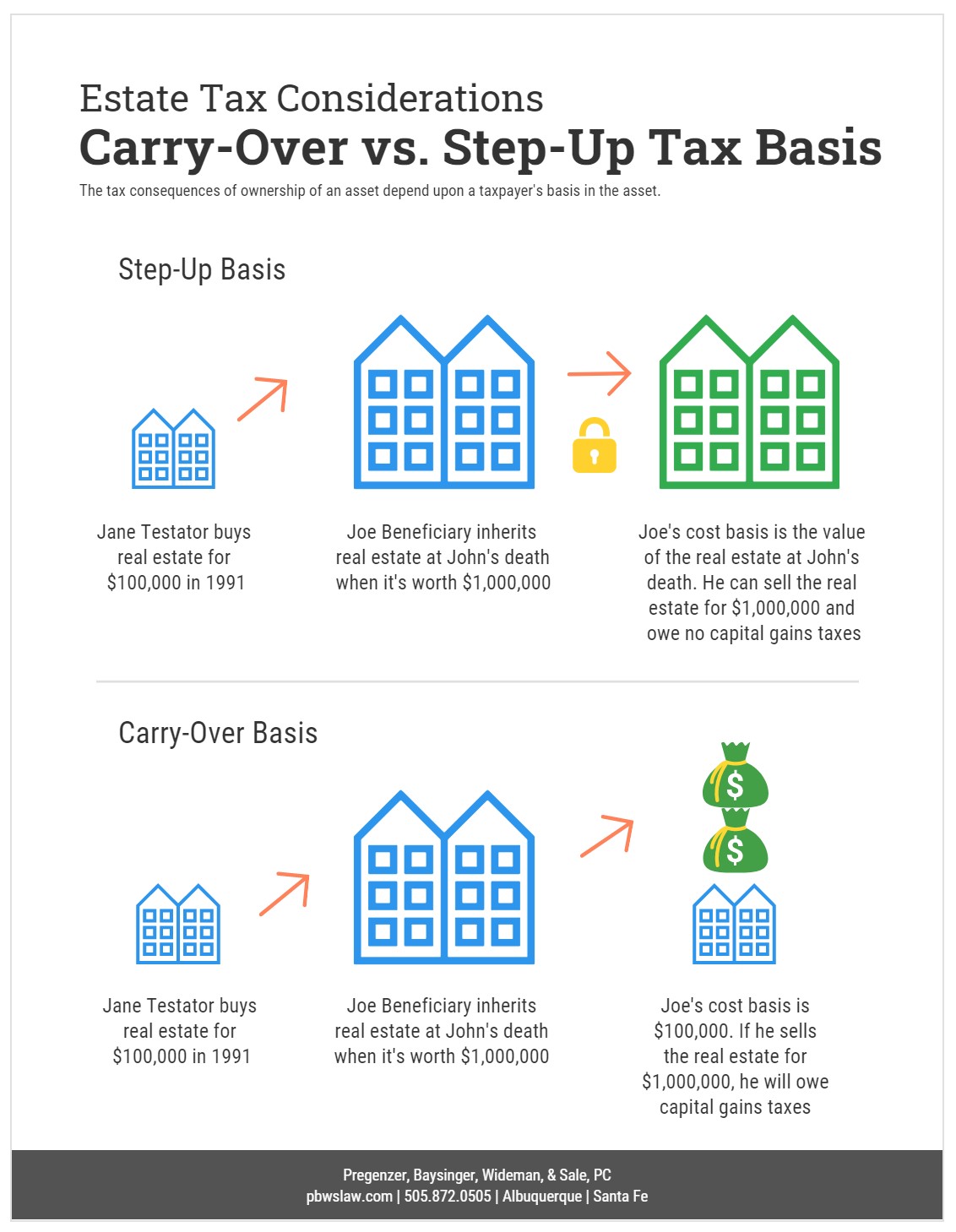

As we enter into a new era of tax code proposals from the Biden administration its important to be thinking about what those changes may mean when planning for the upcoming tax season and retirement. Therefore when an heir eventually sells the asset in the future the capital gains tax would apply to the gain in value since or after the bequeathal.

Pdf What Are Capital Gain And Capital Loss Anyway

WHAT BIDENS CAPITAL GAINS TAX PROPOSAL COULD MEAN FOR YOUR WALLET Anything that is.

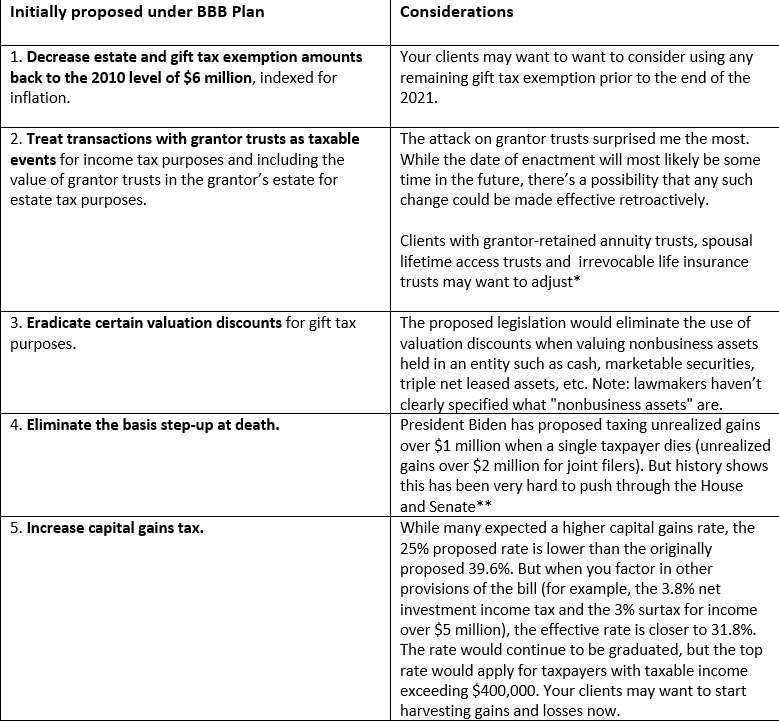

. One of the big surprises included in the Biden administrations first budget released the Friday before Memorial Day weekend was the confirmation that President Joe Bidens proposed capital gains. The new approach also taxes capital gains only upon. This proposal would be retroactive to the beginning of 2021 which.

Retroactive Changes To The Tax Code Are Allowed Can Congress make changes to the Tax Code today that change the rules for yesterday. This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current realization-based systems along with the lock-in effect and tax arbitrage possibilities associated with this deferral advantage. Effective for taxable years ending after 6 May 1997 ie for the full calendar year in.

A Multimillion-Dollar Sale No. September 28 2021. President and Congress hold the power to raise taxes retroactively meaning that the increase could apply anytime during that same calendar year.

In a word yes When it comes to tax policy Congress has. Retroactive Gift Tax Filing to Decrease Capital Gains One reason for someone with below 11mm limit to file a 709 is to show a higher cost basis for a property that was gifted so that when it is sold the capital gains tax is lower for the person they gifted it to. Issue Date December 1988.

The Wall Street Journal reports. A Retroactive Capital Gains Tax Increase. Reduced the maximum capital gains rate from 28 percent to 20 percent.

But additionally he wants this implemented retrospectively to April 2021. With no tax law changes your client would expect capital gains tax. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

This occurs in years when youre in the 0 capital gains tax bracket. President Bidens expected 6 trillion budget assumes that his proposed capital-gains tax rate increase took effect in late April meaning that it would already be too late for high-income investors to realize gains at the lower tax rates if Congress agrees according to two people familiar with the proposal. This isnt a judgment on the merits or demerits of raising top capital gains rates either to Bidens preferred 396.

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. Accordingly the term retrospective tax generally refers to a tax increase based upon. Individuals would have a 1 million exclusion for capital gains and an additional exclusion of 500000 for a personal residence.

Signed 5 August 1997. Biden plans to increase this to 434 percent for households earning more than 1 million. Thus the capital gains tax excluding the surtax for 2020 would be 800000 20 times 4 million.

A previous charge or a new charge is due at the end of any transaction. The CEOs warned the proposal could spook investors and small businesses inflicting more economic damage. The National Law Review points out that in recent years retroactive tax changes have occurred as late in the year as August.

One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all. But the STEP Act would mean that a person inheriting an asset would be taxed on the assets appreciation before they took ownership or control. The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over 1 million with those.

Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396. Legally the US. Xidens proposed budget for the upcoming fiscal year assumes that a hike in the capital-gains tax rate took effect in late April meaning that it already would be too late for high-income investors to realize gains at lower tax rates according to a Wall Street Journal report out Thursday citing people familiar with the proposal.

President Biden has been clear that he wants to raise taxes on capital gains for high earners. It would be a retroactive capital gains tax. 1 Harvesting capital gains is the process of intentionally selling an investment in a year when any gain wont be taxed.

An old tax collected at the end of a transaction is referred to as a retrospective tax. Short-term capital gains are taxed at the same rate as federal income taxes which can be up to 37 while the highest long-term capital gains. The 0 long-term capital gains tax rate has been around since 2008 and it lets you take a few steps to realize tax-free earnings on your investments.

But until a Wall Street Journal scoop published Thursday night it wasnt known that he wants those taxes raised retroactively. Those changes usually involve rate decreases however which are typically easier.

Historical Past And Retroactive Capital Gains Rate Modifications T3elearning

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Constitutionality Of Retroactive Tax Legislation Everycrsreport Com

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Capital Gains Tax A Primer Atlanta Tax

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Pdf Effects Of Tax Integration And Capital Gains Tax On Corporate Leverage

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

What Are The Details About Capital Gains Quora

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Estate Taxes Under Biden Administration May See Changes

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

![]()

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others